Courtesy Advertising Age Magazine. Published on .

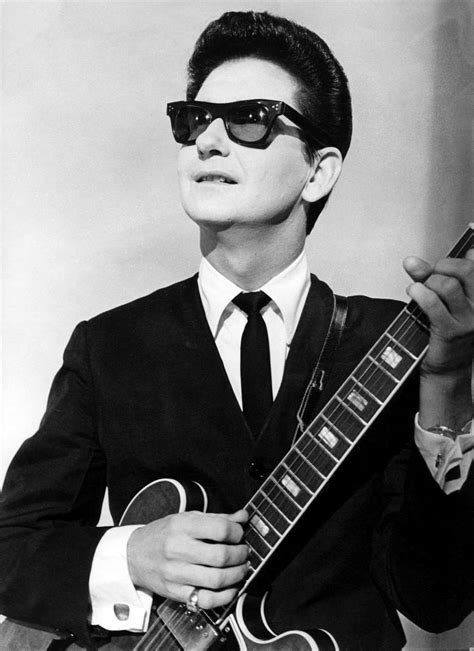

Norma and Norman on A&E’s just-concluded ‘Bates Motel.’ Credit: JosephLederer_A&E.

Norma and Norman on A&E’s just-concluded ‘Bates Motel.’ Credit: JosephLederer_A&E.

;

For some TV networks, the Golden Age of Television is losing its luster.

MTV, A&E and WGN are all cutting back on high-end productions after failing to attract big enough audiences in an increasingly crowded landscape.

Their decision to retreat from non-reality series suggests a reckoning may loom for other networks and the studios that make shows. Last year, the industry produced a record number of original scripted programs — a total of 455. John Landgraf, head of the FX network, has warned of a glut that he’s labeled “peak TV,” arguing the networks and streaming services are making more than viewers can watch.

“It seems like the era of peak TV driven by an explosion of cable originals is coming to an end,” Michael Nathanson, an analyst at MoffettNathanson, said earlier this month.

TV networks, almost all of them owned by large, diversified entertainment companies, have been pouring money into original series to compete with fast-growing streaming services, like Netflix and Amazon, which combined will spend an estimated $11 billion this year on TV shows and movies, including the rights to shows that have already aired elsewhere. In many cases, the networks’ parent companies supply the subscription-video services with new programs and reruns.

But the gusher of new shows airing on the TV networks shows signs of slowing. While the number of series increased again last year, the growth came from Netflix, Amazon and Hulu. Every type of traditional TV network, from broadcast to cable to premium cable, cut back original production in 2016.

TV ratings are down just about everywhere as cord-cutting accelerates and less popular networks are left out of new cable-like TV services from Dish Network, Hulu, YouTube and DirecTV.

Original series, in particular, have struggled to stand out. In the first quarter, the audience for original TV dramas fell 15% from a year earlier, Nathanson said. Meanwhile, unscripted reality shows grew 1%, sporting events increased 6%, and news programming spiked 22%.

Cable network executives say it doesn’t make sense to invest in expensive dramas unless you’re willing to make a lot of them. One or two high-end drama shows won’t change how viewers, distributors and advertisers see your network, even if fans drop in to watch the occasional favorite. While that may work for Netflix, which can gain subscribers from a single show, it’s not good for basic cable networks, which must keep people tuned in to sell ads.

READ THE REST OF THIS FEATURE HERE AT AdAge.com

What a concept! Produce original programming and lots of it! What about this do Canadian providers not understand?